- How strict fraud prevention leads to false declines

- The impact of false declines on businesses

- How false declines erode consumer trust and CX

- What you can do to earn and keep consumer trust

- How ClearSale helps businesses eliminate false declines

- And much more!

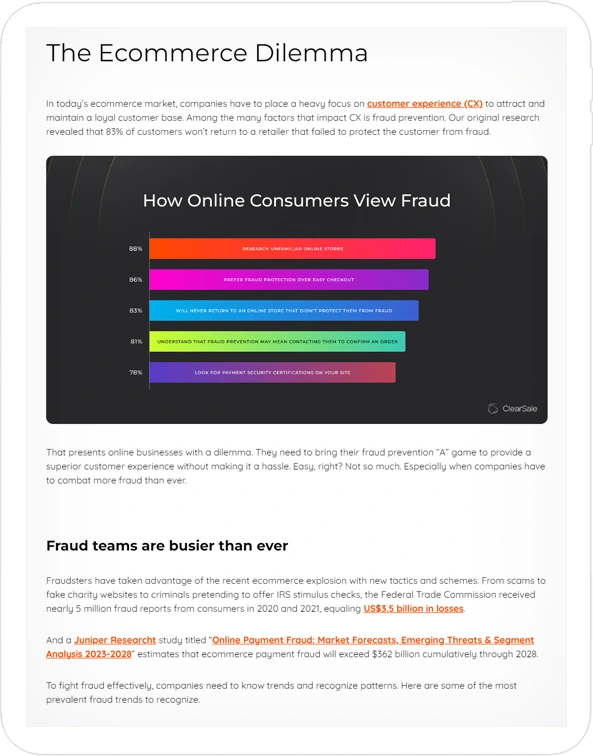

Think You’ve Got Fraud Protection Handled?

If your approach to fraud protection involves strict fraud filters and an automated system that declines anything that even looks like fraud, you could be creating a bigger problem for your business. Today’s customers are twice as likely to have their order declined than to experience fraud. That’s not good for business. Luckily, we have a resource for you:

“Ecommerce False Declines & Consumer Behavior.”

download nowBy downloading this guide,, you’ll learn:

About this Guide

Ecommerce False Declines & Consumer Behavior

False declines are becoming more common

Our original research revealed that 25% of consumers experience at least one false decline, and 36% experience two or more false declines yearly. Even when given the opportunity to try the transaction again, only 22% of customers will do it.

Customers have no patience for false declines

Over 40% of customers will never shop on a site again after they’ve experienced a false decline, and over 30% will complain on social media, which can further damage the company’s reputation. The reality is, about 65% of false declines are legitimate orders. That means companies are turning away a large number of good sales and sacrificing their brand at the same time.

The result: False declines are costly

Businesses that turn away valid customers don’t just lose the amount of that sale. They likely lose the lifetime value of that customer. So, the cost is the average spend for the customer, times the number of years they would be shopping on your store. The younger the customer, the greater the cost.

Frequently Asked Questions (FAQs)

-

What are false declines?

-

False declines — sometimes called “false positives” — happen when a customer’s valid order is declined because the business mistakes it as fraudulent.

A false decline doesn’t necessarily mean that the transaction won’t eventually go through. There are two types of declines:

- Hard declines are the result of an error or issue that cannot be resolved immediately. The decline isn’t temporary, and subsequent attempts with the same payment method will likely not be successful. Customers often walk away from false declines angry and embarrassed.

- Soft declines are due to temporary issues and can be retried. Subsequent transaction attempts with the provided payment method information may process successfully. This is dependent on the customer’s willingness to retry the purchase.

-

Why do I need to fill out the information requested?

-

We will always keep your personal information safe.

We ask for your information in exchange for this valuable resource to improve your website user experience and send you additional information that is related to this topic and growing your business. You can read more about our privacy policy here.

-

Is this actually free?

-

Of course it is!

We’re simply sharing our industry knowledge that our clients and team members find helpful. Let us know if you have any additional fraud or ecommerce questions or visit our Ecommerce Fraud Resources hub to access even more helpful guides, articles and tools.

Fill out the form and optimize your fraud prevention process today!

ClearSale Reviews

ClearSale Has Been Amazing!

"Quick fraud detection on all orders. Ease of use on the platform. Never had a chargeback."

Anonymous

Great service & peace of mind

"ClearSale offers a great service that comes with complete peace of mind. Their staff is easy to reach and pleasant to deal with. I particularly enjoy that I no longer have to spend hours a day investigating customers who purchase from our online store and trying to determine if they are legitimate or not. No more rolling the dice with our business. ClearSale also backs up all their..."

Barry N.

Saves a ton of time and headaches!

"I don't have to spend time researching orders to see if they are fraud or not. I love that ClearSale backs up their approvals with a money-back guarantee if the order turns out to be fraud."

Anonymous

Great Value

"The product is great. We've never had a complaint from day 1. The setup was easy. And the continued service has been exceptional. With a product like this, you want it to work behind the scenes without ever thinking about it. That's ClearSale. It does exactly what it is supposed to do and never causes us troubles."

Nathan N.