-

Introduction

Ecommerce Industry Guide: Consumer Electronics

-

Chapter 1

Industry Overview

-

Chapter 2

Consumer Electronics & Ecommerce

-

Chapter 3

Fraud Risk in the Consumer Electronics Industry

-

Chapter 4

How the Consumer Electronics Industry Can Combat Ecommerce Fraud

-

Chapter 5

How ClearSale Helps Consumer Electronics Companies

-

Chapter 6

ClearSale Helps Motorola Wipe Out Chargebacks and False Declines

Chapter 1: The State of the Consumer Electronics Market

Industry Overview

The term "consumer electronics" can refer to any type of electronic equipment intended for home or personal use (as opposed to professional use). In the modern era, most consumer electronic devices are based on digital technology.

Electronic home appliances (such as washing machines and refrigerators) are generally considered to be in a separate category. However, the two markets have begun to blend as internet-connected appliances and the Internet of things (IoT) gain wide acceptance.

Consumer Electronics Industry Revenue

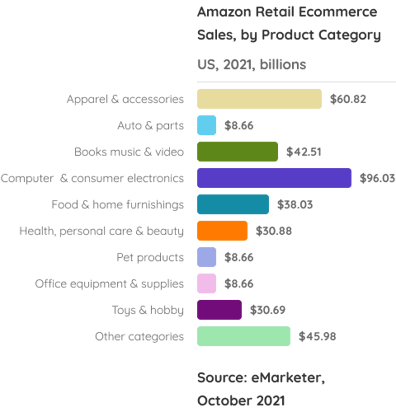

Not only did the pandemic thrust ecommerce forward to realize five years of growth and more than $3.9 trillion in online sales within one year, but it also created a “captive” market for the consumer electronics industry: Consumers were stuck in their homes for an extended time with little other than their consumer electronics to occupy them. In the United States, consumer electronics outsold every other product category on Amazon in 2021 by a wide margin.

According to Statista data in 2021, worldwide revenue in the consumer electronics segment was projected to exceed $291 billion in 2022, mostly coming from China. In that same year, the average revenue per user (ARPU) in the consumer electronics industry is projected to exceed $330.50.

Revenue is expected to increase at a compound annual growth rate of 7.2% through 2025, reaching a projected market value of over $930 billion.

By that point, the number of worldwide users of consumer electronics will top 2.9 million, which amounts to a penetration rate of 37.2% of the world population.

Consumer Electronics Industry Subcategories

It’s difficult to summarize the state of the consumer electronics industry because the field includes so many different types of products. Some product categories are growing rapidly in sales, while others have stagnated or are declining, as the technology becomes outdated or goes out of fashion.

Here are some of the most important verticals within the consumer electronics market:

Cameras and video products

Sales of standalone cameras and video recorders are shrinking steadily as casual consumers increasingly rely on their smartphones for snapshots. Sales of cameras with interchangeable lenses (preferred by photography enthusiasts and professionals) remain steady.

Audio products

The audio and sound equipment subcategory includes electrical devices used to play, reproduce or record sound: speakers, stereos, headphones, turntables, mixers, MP3 players, microphones and so on.

One of the most exciting product types within this group is the “true wireless hearable” (earbuds or headphones that aren’t connected by a cord or neckband). As the quality of wireless earbuds continues to deliver better audio quality and connect with more smart and user-friendly devices, the market will continue to grow. The global true wireless hearable market size is expected to reach $14.51 billion by 2028 and is anticipated to increase at a compound annual growth rate of 14.4% through 2028.

Gaming

The gaming industry includes the hardware used to play video games (consoles, controllers and other accessories), as well as the games themselves. Valued at over $198 billion in 2021, the gaming industry is expected to be valued at over $339 billion by 2027 — and is anticipated to increase at a compound annual growth rate of 8.94% through 2027.

Pandemic-related lockdowns created a huge surge in players and revenue, as people discovered (or rediscovered) gaming. Other factors that have contributed to growth include:

- Technology advancements in the way games are designed and delivered.

- Diversification of platforms, including PlayStation and Xbox, as well as cloud platforms.

- 5G connectivity facilitates greater bandwidth and significantly improved services.

Gaming was once considered the domain of young males, but the activity now spans generations and genders. Today, the average gamer is 35 and about 46% of gamers are female.

More statistics show how the industry has changed:

- More than 57% of game developers live in the United States.

- Free-to-play games account for over 85% of all game revenue.

- The global esports industry is growing at a rate of 30% year-over-year.

- There are over 2.2 billion mobile gamers.

PCs / Notebooks / Netbooks / Tablets

While desktop PCs were once the norm, they’re steadily being replaced. In 2020, worldwide sales of PCs were at just under 80 million — down from 94 million the year prior. By 2025, that number is expected to decrease to 69.6 million. Inversely, laptop sales are increasing. In 2020, 222.5 million laptops were sold worldwide. Sales are expected to rise to 272.4 million units by 2025.

Tablets, on the other hand, will begin to taper slightly, decreasing from 163.5 million units in 2020 to 141.5 million in 2025.

Mobile Phones

The smartphone revolution transformed the consumer electronics industry. Throughout much of the world, smartphones have become essential tools not just for communication but also for entertainment, health, socializing, shopping and work.

Global smartphone sales exceeded $110 billion in the beginning of 2022, down 2% from the previous year. The reason? Part of it is price, another factor is superior technology — hello, 5G — and the third is supply-related. The pandemic created a major slowdown in manufacturing and shipping. Just about every industry is working to catch up.

Other Consumer Electronics Subcategories

Other growing segments of the consumer electronics market include:

Drones

The retail consumer drone market is expected to reach $63.6 billion in revenue by 2025. Consumers use drones for fun and dramatic aerial photography.

The Internet of Things (IoT)

The emerging IoT market is a category all its own and is a network of internet-connected objects that use embedded sensors to collect and exchange data. A popular application of IoT is in smart home devices, such as light bulbs and thermostats. By 2029, worldwide spending on the IoT is expected to exceed $2 trillion.

E-Cigarettes and Vaping

With traditional cigarettes slowly falling out of favor in many countries, the global market for e-cigarettes and vaping devices is expanding. Valued at $6 billion in 2020, the industry experts anticipate a compound annual growth rate of 27.3% through 2028.

Consumer Electronics Buyer Demographics

Who’s buying consumer electronics around the world? Demographics vary widely by product category and region.

For example, in the United States, 95% of adults aged 18-49 and 83% of those aged 50-64 own a smartphone. Within the same age groups, only half own a tablet.

What we know from our own original research is that millennials and Gen Z tend to be early adopters of new technology and prefer to use their smartphones, especially to shop online. In fact, 98% of Gen Z own a smartphone and 91% get their first mobile device before age 16.

Even older adults have become more tech savvy. In 2021, 61% of adults aged 65+ owned a smartphone, 44% owned a tablet and 45% used social media.

Looking in other regions of the world, technology usage varies. In countries with younger populations, such as Peru, smartphone penetration is fairly high. In European countries like France, roughly half the population are smartphone users. In countries like China, smartphone usage has dramatically increased to 66% of users.

Global Differences in the Consumer Electronics Industry

The following table compares projected consumer electronics revenue and growth in various markets (all data from Statista sourced in 2019):

| Market | Projected 2020 Revenue | Compound Annual Growth Rate, 2020 to 2024 |

|---|---|---|

| China | $151.4 billion | 2.1 % |

| United States | $65 billion | 4 % |

| Europe | $72.2 billion | 4.7 % |

| South America | $9.2 billion | 11.1 % |

| Canada | $6.2 billion | 2.3 % |

| Japan | $13.8 billion | 3.1 % |

As for the makers of consumer electronics, Investopedia reported in 2019 that China accounts for 23% of all electronics exports, followed by Hong Kong at 11%, and the United States at 6.8%.

Emerging Trends in Consumer Electronics

Since the beginning of the pandemic, we’ve seen consistent trends that are shaping the consumer electronics industry.

Greater connectivity

As adoption of IoT expands, consumer electronic devices will become elements of interconnected, cross-functional networks. IoT-enabled devices can be monitored for malfunction, needed maintenance or low supplies. This provides an excellent opportunity for companies to promote subscription-based maintenance or supply replenishment services.

Supply chain challenges

The COVID-19 pandemic caused widespread supply chain shortages within the consumer electronics industry that continue to be an issue. Product launches have been delayed as businesses scramble for replacement components. Successful companies are solving this problem with innovation, encouraging procurement and engineering teams to work together to come up with creative new ways to ensure that the components in the design are ones that can be readily obtained.

Changing demographics and consumer attitudes

During the pandemic, 61% of consumer electronics purchases were made online — a trend that has become a habit, changing the game for consumer electronics retailers of all sizes. The typical customer profiles of the past will no longer work in today’s environment because consumer habits have shifted — a lot.

In our original research report, “State of Consumer Attitudes on Ecommerce, Fraud & CX 2021,” we discovered:

- About 13% made their first purchase online during the pandemic.

- The increase in younger shoppers has changed which payment methods online retailers should offer.

- If “friction” wasn’t a boardroom buzzword before, it is now. A time-consuming checkout process will send 35% of online shoppers to a competitor.

- Retailers that are overly zealous in fighting fraud pay the price with their reputation. An astounding 40% of consumers will never shop with a company again after a false decline. Even worse, 34% will take their beef to social media.

Increased exposure to fraud

Speaking of fraud, increased volume in the consumer electronics industry will be accompanied by increased attention from fraudsters — especially as companies shift to ecommerce to compensate for the pandemic-related loss of brick-and-mortar sales.

![[Industry Focus] Fraud Risk Profile for Electronics Retailers](https://offer.clear.sale/hs-fs/hubfs/Consumer-electronics.png?width=1064&name=Consumer-electronics.png)